foto: TikTok/@radhikaalthaf

Brilio.net - In this era, shopping is very easy. One of them is shopping online. Online shopping activities are proof of the victory and convenience of increasingly advanced technology. With technology, shopping abroad has become even easier. Just open the internet and order, then the goods will easily reach their destination.

One item that is often purchased abroad is shoes. With technology, you don't have to wait like before when new shoes were launched. So, with this convenience you don't have to bother going abroad. But remember, you also have to pay customs duties if you want to buy shoes from abroad.

So, apart from paying the price of the goods, shipping costs and insurance, you are also required to pay several taxes. In tax regulations in Indonesia, this is known as Import Tax (PDRI) which consists of Import Duty, VAT or PPnBM and Income Tax (PPh).

Recently, netizens were shocked by a man who uploaded a video of his complaints when he bought football boots for IDR 10.3 million from abroad. Through his TikTok account @radhikaalthaf, he complained that he had to pay customs duties of IDR 31.81 million.

photo: TikTok/@radhikaalthaf

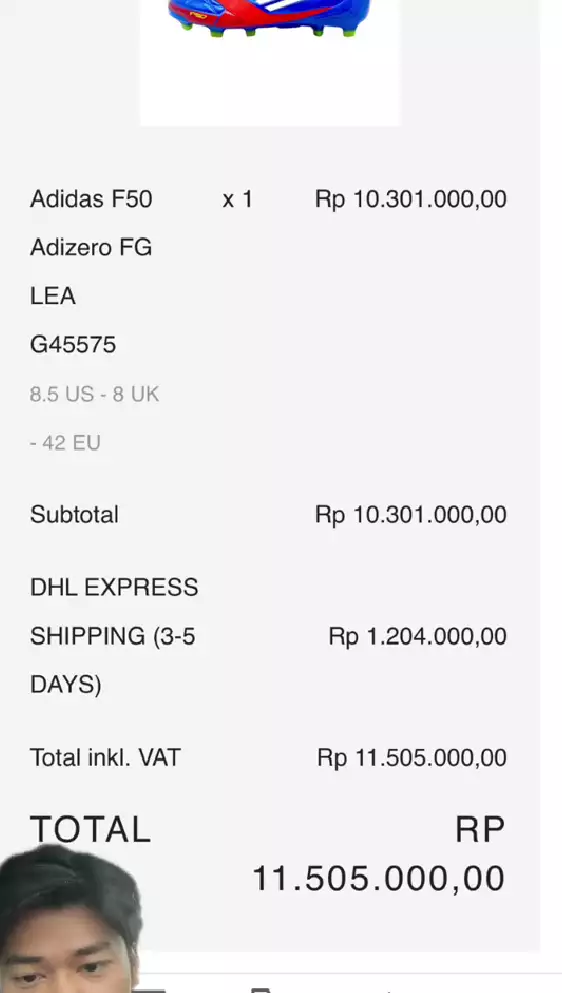

"Hello Customs and Excise, I want to ask you. What do you set the basic import duties for? I just bought shoes, the price is Rp. 10.3 million, shipping is Rp. 1.2 million, the total is Rp. 11.5 million and do you know how much the import duties are? Here (while showing a screenshot of the notification from the sending service," said the man, quoted by brilio.net , Tuesday (23/4).

The man asked how the calculation of import duties was more expensive than the price of the shoes he bought from abroad. According to him, he should only pay IDR 5.8 million with details of 25 percent import duty, 11 percent VAT and 11 percent import PPh. He also admitted that he had ensured that his calculations were in accordance with the calculations from the Customs application.

photo: TikTok/@radhikaalthaf

"This is the calculation I used using your mobile application. Customs and Excise is IDR 5.8 million. Then where do you determine the import duty on my shoes? You charge IDR 30 million for shoes priced at IDR 10 million, it doesn't really make sense," he said again.

With this complaint, the Directorate General of Customs and Excise (DJBC) provided an explanation via the official account at X @beacukaiRI. DJBC explained that the determination of customs duties occurred due to a discrepancy in the determination of customs value or CIF.

For the importation carried out by the person concerned, the goods delivery service used, in this case DHL, provides a CIF or customs value of 35.37 US dollars or around Rp. 562,736. This information is also used by customs to determine the value of goods.

However, after carrying out several further checks, the CIF value or customs value of the goods was 553.61 US dollars or Rp. 8,807,935.

"For these discrepancies, administrative sanctions are imposed in the form of fines in accordance with Minister of Finance Regulation Number 96 of 2023 Article 28 part five, article 28 paragraph 3," wrote the DJBC on the official account X @beacukaiRI.

photo: X/@beacukaiRI

Details from the DJBC of import duties and import taxes on the products concerned are 30 percent import duties IDR 2,643,000, 11 percent VAT IDR 1,259,544, and 20 percent Import PPh IDR 2,290,000, and Administrative Sanctions IDR 24,736,000 with a total bill Rp. 30,928,544.

"The amount of administrative sanctions in the form of fines is imposed in accordance with PP number 39 of 2019 article 6 concerning the Imposition of Administrative Sanctions in the form of Fines in the Customs Sector," he explained again from the DJBC.

(brl/jad)