Brilio.net - One of the documents that has high economic value and can be traded is securities. Generally, securities are often used as an instrument to secure or facilitate transactions. The existence of this letter is to provide trust and legal certainty for the parties involved.

There are various types of examples of securities that can be found, ranging from stocks, bonds, to promissory notes. Each type of security has different characteristics and functions, according to financial needs. Understanding these types is very important for anyone involved in the economic sector.

The function of the example of securities is not only limited to transaction tools, but also as a means of investment and asset protection. Securities provide long-term benefits to their holders who play an important role in maintaining financial stability.

Therefore, understanding the function of securities is an important step in smart financial management. Here is a complete review of examples of securities, their meaning, types, and functions, adapted by brilio.net from various sources, Thursday (29/8).

Definition, types and functions of securities

photo: freepik.com

Securities are legal documents that have financial value and can be traded or transferred from one party to another. Securities are usually in the form of certificates or other instruments that indicate ownership or certain rights that are recognized by law.

These securities are often used in financial transactions to secure the economic rights of their holders, such as the right to profit, interest payments, or investment returns. Securities can be issued by companies, governments, and financial institutions, thus playing an important role in the business and investment world.

The types of securities include:1. Stocks

Shares are securities that indicate ownership of a portion of a company. Shareholders have the right to a portion of the company's profits and the right to vote at general shareholder meetings.

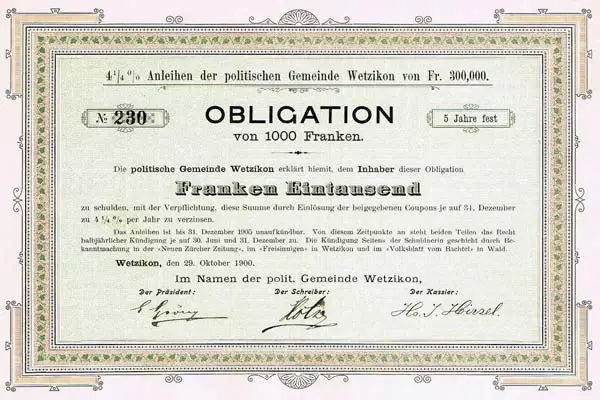

2. Bonds

In addition to stocks, there are bonds. Securities that are a statement of debt from the issuer to the bondholder, with a promise to pay interest periodically and then return the principal at maturity.

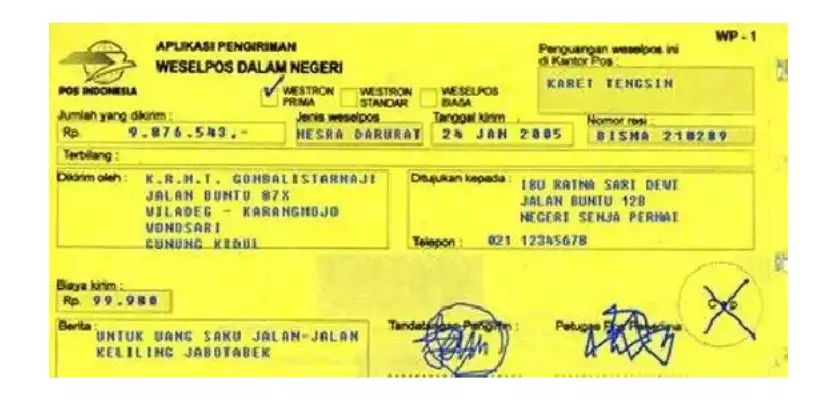

3. Money order

Next, there is a promissory note, namely a valuable document containing a payment order from the drawer to a third party to pay a certain amount of money at a specified time.

4. Certificate of deposit

A certificate of deposit is a security issued by a bank, indicating that a sum of money has been deposited for a specified period of time at a stated interest rate.

5. Commercial Paper

Well, short-term securities issued by companies to meet short-term working capital needs.

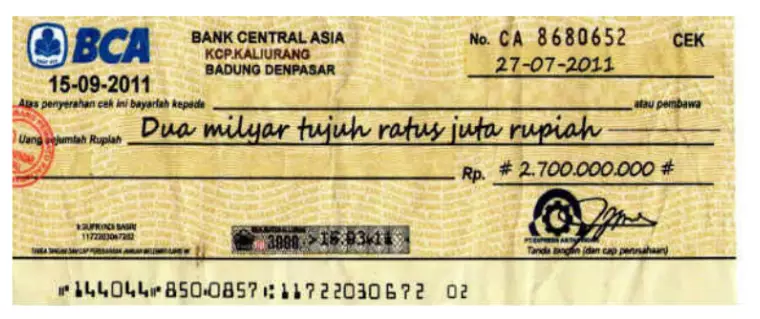

6. Check

A check is an unconditional order given by a person to a bank to pay a certain amount of money to the party designated on the check.

Functions of securities1. Transaction tools

Securities are used as a tool to conduct financial transactions. For example, stocks are used to raise capital for a company, while bonds are used to borrow funds.

2. Investment instruments

Securities such as stocks and bonds are used as investment vehicles. Stockholders expect to receive dividends, while bondholders receive interest.

3. Debt guarantee

Not only that, securities can be used as collateral in loans. For example, companies can mortgage stocks or bonds to get funds.

4. Transfer of rights

Next, securities facilitate the transfer of rights or ownership without the need for complicated legal processes. By having securities, these rights can be sold or transferred to other parties easily.

5. Asset protection

Securities can also serve as a tool to protect assets, for example by purchasing bonds which are considered safe investments.

6. Liquidity

Finally, securities provide liquidity to their holders, as they can be traded on the secondary market, allowing their holders to convert the securities into cash quickly.

Examples of securities

photo: freepik.com

1. Bill of exchange securities

photo: Special

2. Bank check valuable letter

photo: Special

3. Bond securities

photo: Special

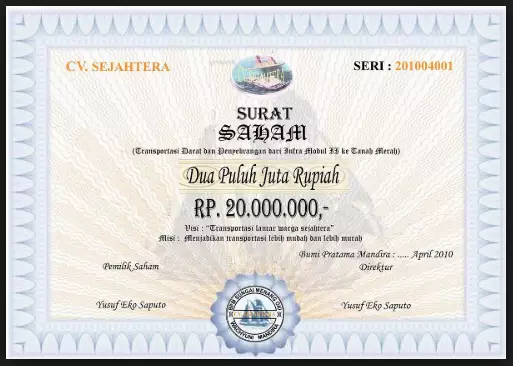

4. Stock securities

photo: Special

(brl/mal)